September 1, 2025 | 12:00am

MANILA, Philippines — Headline inflation is anticipated to edge larger in August after slipping to a six-year low of 0.9 % in July, with economists projecting modest worth pressures from larger meals, gasoline and energy prices.

UnionBank chief economist Carlo Asuncion stated the August shopper worth index (CPI) probably rose by 0.9 to 1.5 %, with a central forecast of 1.2 %.

“The slight uptick from July’s 0.9 % is pushed by rising pass-through results from larger vitality costs, wage changes and imported items, particularly amid a weaker peso,” he stated.

He flagged rising palay costs in rice-producing areas forward of the federal government’s 60-day rice import ban as an upside danger, whereas provide disruptions from climate disturbances might additionally add strain.

Alternatively, base results and sustained rice deflation, which fell by 15.8 % year-on-year in July, might mood headline CPI.

UnionBank expects inflation to common 1.6 % for 2025, under the Bangko Sentral ng Pilipinas (BSP)’s two to 4 % goal band.

Moody’s economist Sarah Tan additionally projected the CPI to climb modestly by 1.1 % in August, citing larger transport and gasoline prices.

Nonetheless, she famous easing meals costs from authorities measures such because the Division of Agriculture’s decrease most retail worth on imported rice.

“That stated, a number of dangers stay. Because the Philippines stays susceptible to local weather shocks, climate disturbances might have an effect on meals harvest output, probably reversing the downward pattern in meals inflation,” she stated.

World oil costs additionally pose a risk to inflation if geopolitical tensions escalate. Nonetheless, inflation ought to common round two % in 2025 barring sustained provide shocks, Tan stated.

World financial institution Citi shared the identical 1.1-percent forecast for August, however highlighted dangers from latest wage hikes, rising electrical energy charges and the suspension of rice imports.

The financial institution stated the BSP might ship extra fee cuts in October and February subsequent 12 months, however warned that easing may be delayed if rice and energy tariffs drive inflation larger or if third-quarter financial progress proves extra resilient than anticipated.

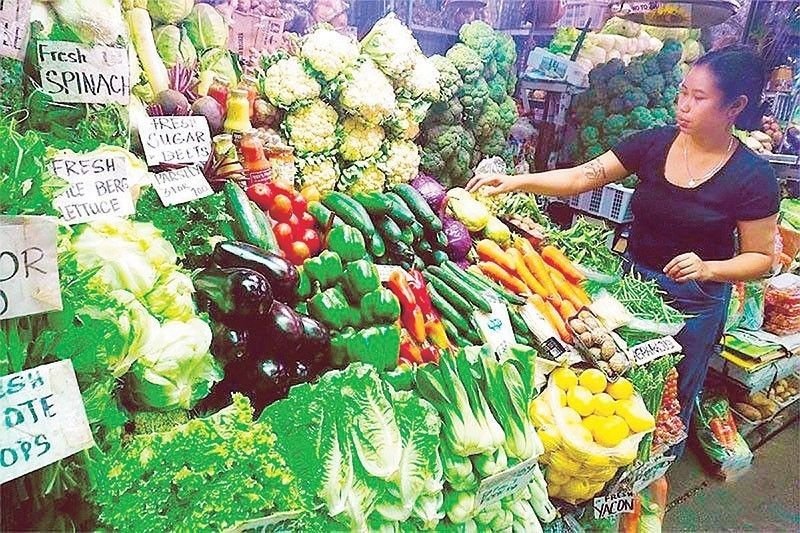

Reinielle Matt Erece, an economist from Oikonomia Advisory & Analysis Inc., pegged inflation at one % in August, pointing to barely larger vegetable and electrical energy prices.

However he confused that inflationary pressures stay weak general as a consequence of sluggish demand and smooth international oil costs.

Inflation has stayed under the central financial institution’s two to 4 % goal for the previous 4 months, giving the BSP room to ease coverage charges by a complete of 150 foundation factors since August final 12 months.

The Philippine Statistics Authority will launch the official August CPI report on Sept. 5.